European Investment Bank proposes package in response to COVID-19

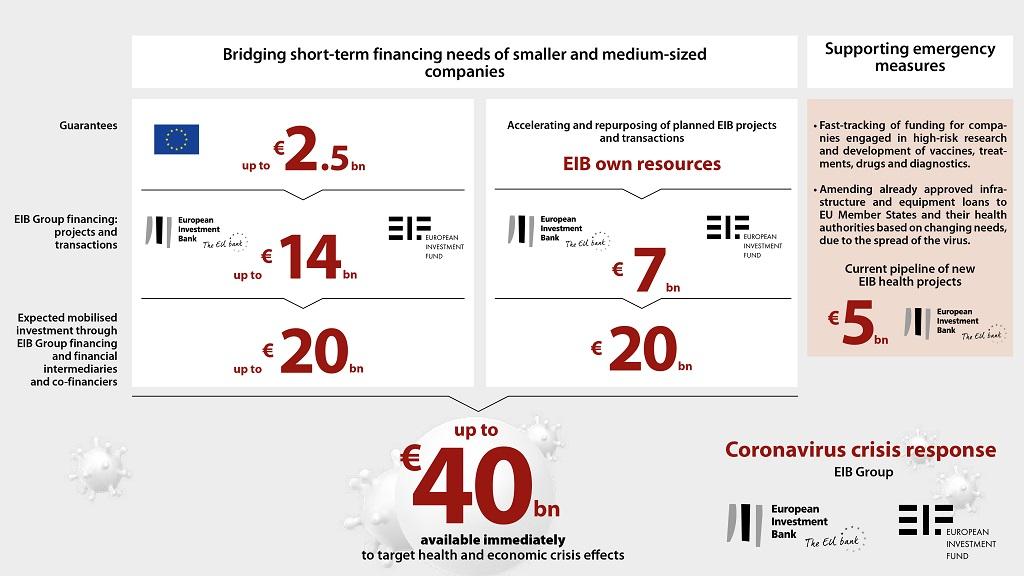

Following the strain placed on the European economy by the rapid spread of the new coronavirus, the European Investment Bank (EIB) has proposed a plan to mobilise €40 billion of financing. The aim of the package will be to alleviate liquidity and working capital constraints for SMEs and mid-caps.

The EIB Group, including the European Investment Fund, which specialises in SME support, will work with financial intermediaries in EU member states as well as in partnership with national promotional banks to bring about the financial package.

The proposed package consists of:

- Dedicated guarantee schemes to banks based on programmes of immediate deployment - €20 billion

- Liquidity lines to banks to ensure additional working capital support for SMEs and mid-caps - €10 billion

- Asset-backed securities (ABS) purchasing programmes that will allow banks to transfer risk on SME loan portfolios - €10 billion.

The EIB is working closely with the Commission to adapt and adopt fast-tracked procedures in order to make this package a reality.

The EIB has also released a fact sheet on how COVID-19 is affecting the economy. View the fact sheet and learn more about the proposed financial package here.

- Hilary Webb

- 26/03/2020

-

Working Group